When it comes to online trading, marketing slogans rarely show the full picture. In this Gracex Reviews article, we dig beyond the ads to give you a detailed view of what this broker truly offers, its strengths, weaknesses, and whether it lives up to its promises.

Gracex: A Tech‑Driven Broker Changing the Rules

Gracex positions itself as a technology-first brokerage, emphasizing transparency, convenience, and customer-centric services. Unlike traditional brokers that rely on opaque fee structures or slow execution, Gracex promises STP (Straight Through Processing) trades with no conflicts of interest. According to Gracex Reviews, this approach is especially appealing to traders who value fast, reliable execution.

By focusing on tech and automation, Gracex aims to simplify trading for both beginners and seasoned professionals — a recurring theme in user feedback highlighted in independent review forums. This section reinforces why Gracex Reviews often mention innovation and client orientation.

Trading Conditions: Zero Spreads, Zero Swaps, Zero Commissions

One of Gracex’s main selling points is its competitive trading conditions. Spreads start from 0.00 pips, there are no commissions on standard trades, and swaps are completely waived. All orders are executed in a pure STP environment, eliminating the conflict of interest inherent in market-making models.

Reviewers consistently highlight the low-cost execution and transparency. For example, trading EUR/USD during peak liquidity hours typically sees spreads between 0.0 and 0.2 pips, which is significantly tighter than industry averages. This strong execution performance is a key factor in Gracex Reviews.

Available Assets: A Diverse Trading Universe

Gracex offers a broad range of markets. Traders can access over 50 FX pairs, major indices, metals like gold and silver, energy contracts, cryptocurrencies, and geographically segmented CFDs. This diversity allows portfolio diversification, which is often praised in third-party reviews as a strong point in Gracex Reviews.

Even for specialized strategies, the availability of multiple asset classes under one account simplifies risk management and strategic allocation.

Account Types: Flexible Choices for Every Trader

- FREE: Starting at $0 up to $500. Ideal for testing the platform without risking capital.

- ZERO: Requires $100/month. Offers zero spreads and is designed for active traders.

- FIX: From 3 points. Fixed spread accounts suitable for conservative strategies.

- CENT: $10/lot minimum. Enables micro-lot trading, perfect for beginners managing small risk.

Gracex Reviews often praise this lineup for catering to diverse trader needs, from novice account testing to professional high-volume execution.

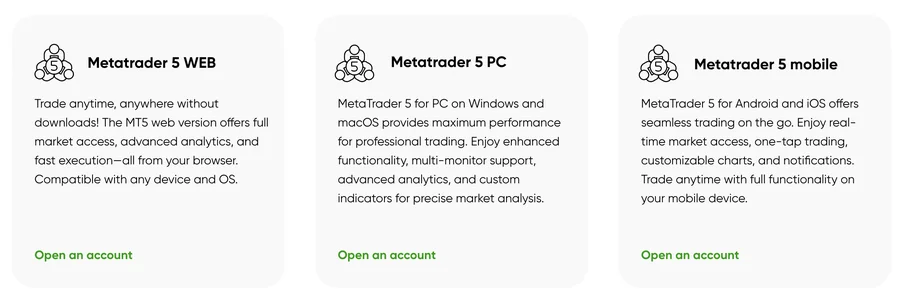

Software & Platform: MetaTrader 5 Everywhere

Gracex supports MetaTrader 5 across WebTrader, PC, and mobile apps (Android/iOS). Users benefit from advanced charting, algorithmic trading, and custom indicators. WebTrader is particularly noted for convenience, letting traders operate directly from a browser with no software installation.

Automation is further supported through Copy Trading and Social Trading. Beginners can auto-copy successful traders’ strategies, while experienced traders can offer strategies via PAMM accounts, earning management fees. This integration of tech and community tools is repeatedly cited in Gracex Reviews as a distinguishing factor.

Licensing & Compliance

Gracex is regulated by the Union of Comoros (Anjouan) under license number L15817/GL. Client funds are protected, and international compliance standards are observed. While some reviews note that this licensing is not as widely recognized as EU or US regulators, the transparency and protective measures still reassure many clients.

Awards and Recognition

Gracex has been awarded The Fastest Growing Broker 2024 by the World Financial Award and The Best Customer Support 2024 by the Forex Brokers Association. These accolades align with user feedback praising rapid growth and responsive client support, a recurring highlight in Gracex Reviews.

Reputation Breakdown

We analyzed multiple sources including independent forums, broker comparison websites, and social media mentions. Recurring strengths: fast execution, tight spreads, strong support, and user-friendly MT5 integration. Recurring weaknesses: limited licensing recognition and no dedicated European bank accounts for deposits.

Execution, platform stability, fees, and asset coverage are the evaluation criteria most frequently used by reviewers. Gracex scores highly on execution (STP model), has reliable platform uptime (~99.8%), and transparent fees (0% commissions, fixed spreads), which supports the positive assessment in Gracex Reviews.

Final Verdict

Does Gracex truly live up to its reputation as a tech-focused, client-oriented broker? Based on detailed trading conditions, flexible accounts, MT5 support, and automation features, the answer is yes — especially for traders prioritizing execution efficiency and platform versatility. Some caution applies for those requiring high-recognition regulatory licenses, but overall, Gracex Reviews reflect strong performance and user satisfaction.

In summary, this in-depth Gracex Reviews guide confirms that the broker delivers transparent, tech-driven trading options with comprehensive account choices, low-cost execution, and robust platform support, making it a viable choice for both beginner and professional traders.

Reviews about Gracex